Did I say mandatory? I meant optional! You’re “free” to die in a cardboard box under a freeway as a market capitalist scarecrow warning to the other ants so they keep showing up to make us more!

That’s how the rich get richer. They never gamble with their own money. They gamble with other people’s money, secured (hah) by their assets.

Yes a minority of us peons who are privileged enough to own property or lots of stocks can play-act like they’re rich by taking out reverse mortgages or doing options trading, but it’s nothing like what the actual rich can get away with.

I think the real solution is not to lend on fake money. Tax or no tax, it wasn’t taxes that caused the market crash in 2008.

I think a law stating you can’t borrow against unrealized gains would be sensible.

You can keep your unrealized gains forever, live of your dividends for all i care, and pay no tax. But realizing them, either through selling or borrowing against, triggers a taxation.

Or doing so, it counts the loan as income and is taxed accordingly. But seriously, the main aim itself can also be taxed. A house is…

Mhm. There’s two very good reason unrealized gains aren’t taxed: volatility and cash flow. Are you and the government expected to swap cash back and forth everyday to correct for changes in the market? No that’s silly. Should people go into debt because they don’t have the cash to pay the taxes of a baseball card they happen to own that is suddenly worth millions? Also silly.

For that same reason, using unrealized gains as security is dangerous, just like the subprime loans market was!

There’s a very good reason they should be taxed; half a dozen people are richer than god, and basically never pay any real amount of tax.

This would effectively lock out every small investor from the stock market due to the liability of both success and failure.

How so?

“Oh no, I made money, better put a small percentage of my gains away for tax season, just like I do with all of my income, because I’m American and lack a good PAYE system”.

Are dividends taxed?

“Yes*”

*As with all rules, it can vary by country. As I understand it, the US tends to double tax dividends, which is a rabbit hole of why the US market chases valuation so hard

Yes

What’s crazy is to calculate the average US income the census folks of the US government exclude billionaires because it would skew reality so much that people would call bullshit on the average with billionaires in the mix.

so they get to be excluded from the “average wage per family” calculations made and distributed by the government.

Ummm I didn’t know they could be used as collateral. I’ll have to research that. It doesn’t sound right to me for the same reason they definitely should NOT be taxed. How does that even work? You buy stocks and you hold them, then, what the government taxes you every year until there ARE no gains. Or perhaps the stock plummeted and you have a loss, but it’s ok, you lost money on the investment AND to the government. Until you sell an investment you haven’t made any money on it and it should NOT be taxed. If you have a 401k this would affect you too, not just rich people.

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

What you’re suggesting would also mean you’re advocating for middle class homeowners to be taxed on a full value of a Home Equity Line of Credit (HELOC) even if they haven’t spent a dime of it yet. Was that your intention?

Homeowners are excluded from capital gains tax for the first 250k for individual filers.

I believe you’re referring to rules on sale of a home where there is a capital gain, meaning you bought the house for $100k and sell it for $350k, no cap gains taxes. We’re in uncharted waters with what @bastion@feddit.nl is proposing. That user (possibly) suggesting it for HELOCs too.

Okay but you can just apply the same logic to a HELOC. If you get a 30k HELOC for a bedroom renovation then it does not count towards capital gains tax.

Even normal capital gains taxes have brackets.

Okay but you can just apply the same logic to a HELOC. If you get a 30k HELOC for a bedroom renovation then it does not count towards capital gains tax.

Wouldn’t this be a double standard if we’re applying @bastion@feddit.nl 's logic? The rich would get taxed on loaned money but the middle class wouldn’t?

This is how… EVERYTHING works… Income tax brackets, 401k limits. I thought this was pretty obvious, from each according their ability and all.

That’s generally how progressive tax brackets work, yes. Technically speaking if I rich person wants to take out a 30k HELOC they’d also not get taxed on it.

I wouldn’t be a huge fan of taxing unrealized gains if we hadn’t been cutting taxes for the rich for 50 years. How else are we ever going to recover from that? These guys COULD have done the right thing and supported sensible taxation policies, but they didn’t, so fuck 'em. At this point it’s either this or the guillotine.

The top 10% own 67% of the wealth in the U.S.

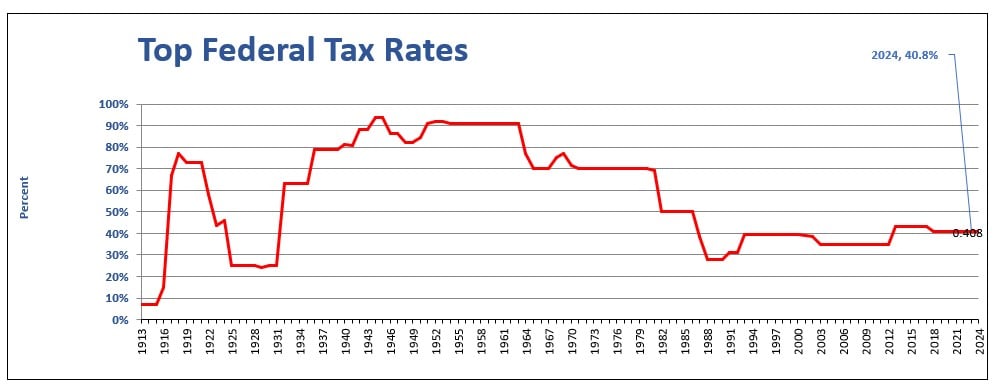

The tax rate during the New Deal (which corresponded with the largest jump in GDP and middle class growth) on people earning $200k and over (now would be like earning $2.5 million/year) was 95%.

During the 50’s through the early 80’s, that tax on the wealthiest was at 70%.

Now it’s at 37%, less than half of what it was during the best years of growth our country ever experienced.

This Unrealized gains tax would only impact people worth more than $100 million who do not pay at least a 25% tax rate on their income.

Additionally, you’d only pay taxes on unrealized capital gains if at least 80% of your wealth is in tradeable assets (i.e., not shares of private startups or real estate). One caveat is that there would be a deferred tax of up to 10% on unrealized capital gains upon exit.

In short, it would not apply to most startup founders or investors, but would impact top hedge fund managers.

They can afford it. TAX THEM.